Identification and Reporting of Beneficial Owners Now Mandatory

Effective 5 March 2018, each entity in Indonesia must identify and report its beneficial owner(s) to Authorized Institutions to combat money laundering and terrorism funding. This new requirement was stipulated in President Regulation No. 13 of 2018 concerning Implementation of the Principle of Knowing Beneficial Owner of Corporations related to the Prevention and Eradication of Money Laundering and Terrorism Financing Crimes (“PR 13/2018”).

This mandatory reporting requirement applies to legal and non-legal entities, i.e. limited liability companies (Perseroan Terbatas), foundations, associations, cooperatives, limited partnerships, Firms/unlimited Partnerships, and other forms of corporations (collectively called “Corporation”).

The PR 13/2018 lists all the beneficial owner criteria for each type of Corporation. Specifically for limited liability company, the criterion is an individual, who:

- owns more than 25% of the company’s shares (as recorded in the Articles of Association);

- holds more than 25% of the voting rights in the company (as recorded in the Articles of Association);

- receives more than 25% of the total annual profit earned by the company;

- has the power to appoint, replace or remove directors and commissioners;

- has the authority or power to direct or control the company without the need for authorization or approval from any party;

- receives benefit from the company; and/or

- is the true (ultimate) owner of the company’s share capital.

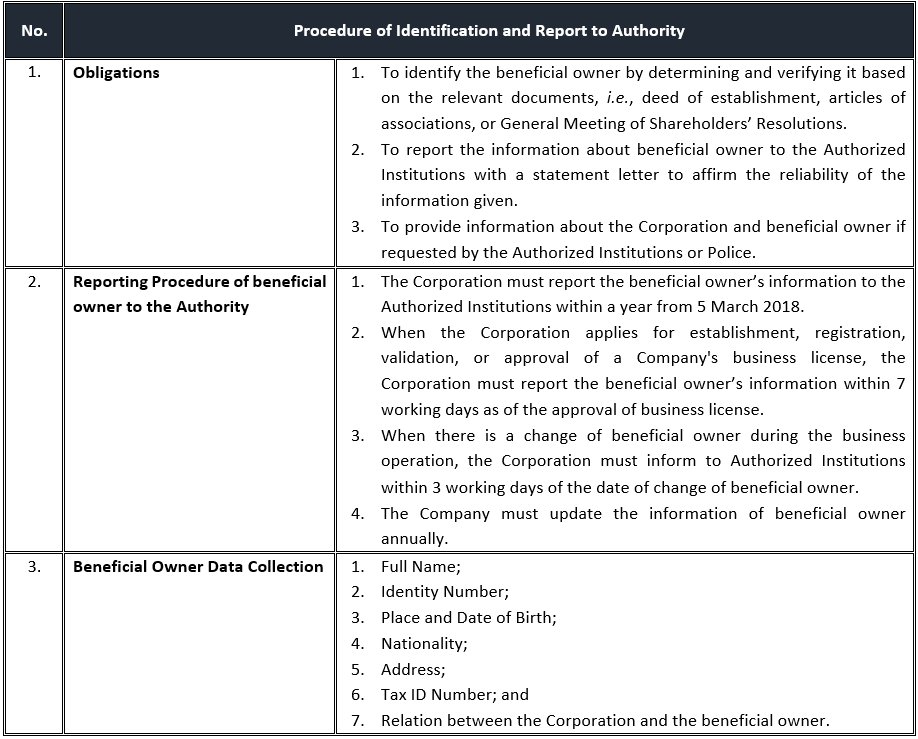

A. Procedure of Identification and Report to Authority

B. The Supervision of Authorised Institutions and Sanctions

Under PR 13/2018, the Authorized Institutions are:

- Ministries conducting governmental affairs in the field of law for limited liability companies, foundations, and associations;

- Ministries conducting government affairs in the field of cooperatives, and small and medium enterprises for cooperatives;

- Ministries conducting governmental affairs in the field of trade for partnership, firm, and other corporate forms; and

- Governmental Institutions that have the authority to supervise and regulate the business of the Corporation.

The Authorized Institutions are empowered to:

- determine the beneficial owner of a Corporation based on the following sources:

- audited report by the Authorized Institutions;

- information from private, government institutions or professionals, who have information about beneficial owner; and/or

- other credible information.

- stipulate a regulation or guidance on the implementation of PR 13/2018;

- audit the Corporation; and

- conduct other administrative activities within the scope of duties and responsibilities in accordance with the provisions of PR 13/2018.

Further, the Authorized Institutions can cooperate with Financial Transaction Reports and Analysis Centre or other related institutions to combat money laundering and terrorism funding.

For sanction, the PR 13/2018 only mentions that any violation of the relevant provisions of PR 13/2018 will be punished in accordance with the relevant laws and regulations.

C. Exchange of Information and Request for Beneficial Owner’s Information

The Authorized Institutions can:

- exchange the beneficial owner’s information with both local and international institutions based on the relevant laws or international agreements; and

- provide the beneficial owner’s information to anyone, who requests such information in accordance with the laws and regulations concerning public information disclosure.

D. Consequence and conclusion

The PR 13/2018’s ultimate objective is combat money laundering and terrorism funding, hence only an individual or natural person is identified and reported as beneficial owner to the authority, hence Corporations are excluded. Further, the obligations to identify and report of beneficial owner also support the Investment Law No. 25/2007, which prohibits nominee arrangement, where an individual uses other people name for establishing and operating a legal entity.

If you have any questions or require any additional information, you may contact Leoni Silitonga, Sianti Candra or the ZICO Law Partner you usually deal with.

This alert is for general information only and is not a substitute for legal advice.